Find new investment opportunities based on Market Sentiment Indicator. Manage watchlist risk with leading indicator of volatility See what influential analysts and investors are saying about stocks in your watchlist

Most Trending

+1.27%

+98.66%

+1.21%

-4.39%

Latest Updates

Market Wrap:

The major indices ended Friday's session mixed as dismal U.S. consumer confidence data sparked concerns about the economic outlook. The downbeat University of Michigan report halted this week's equity rally.

The Nasdaq underperformed, weighed down by tech weakness stemming however, the S&P 500 and Dow managed modest gains.

Inflation expectations ticked up based on the Michigan survey, pushing the U.S. dollar higher. Bitcoin and cryptocurrencies declined amid the unsettled sentiment.

Overall, it was a mixed end to the week. Traders digested conflicting signals on the economy and Fed policy outlook. The consumer confidence miss served as a reminder that the path ahead remains uncertain.

As earnings season starts winding down, all eyes will shift back to upcoming economic data and central bank rhetoric for clearer direction on market trends.

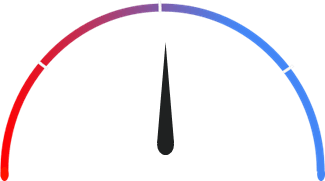

Market Sentiment

Market Sentiment Based on 5,386 events Last updated May 10, 2024 21:21 Wall St. time

Fear Mood

Measures market expectations for future volatility.

Higher values indicate higher expected volatility.

LOW

Volatility

Market Heatmap

The size is based on the total events, the color is based on the sentiment and the height is based on the change in the price

Negative Positive Up Down TSLAGOOGMRNANVAXAMDNVDASNYAAPLMETAAMZNSOUNENBSNAPSGDISSPBAKAMMSFTEQIXEVR

Negative Positive Up Down TSLAGOOGMRNANVAXAMDNVDASNYAAPLMETAAMZNSOUNENBSNAPSGDISSPBAKAMMSFTEQIXEVR168.47

3.35

Annual Meeting

Annual Meeting

Bullish Momentum

Bullish Momentum

Concerns

Concerns

Cut Workforce

Cut Workforce

170.29

4.00

Expansion Activity

Expansion Activity

New Agreement

New Agreement

New Product

New Product

Options Activity

Options Activity

117.31

3.10

Allegations

Allegations

Approval

Approval

Bearish Momentum

Bearish Momentum

Concerns

Concerns

8.88

3.16

Allegations

Allegations

Beat Estimates

Beat Estimates

Concerns

Concerns

New Agreement

New Agreement

151.92

3.52

Bearish Momentum

Bearish Momentum

Buy Opinion

Buy Opinion

Expansion Activity

Expansion Activity

New Agreement

New Agreement

898.78

3.74

Achievement

Achievement

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

Buy Rating

Buy Rating

49.28

3.63

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

Missed Estimate

Missed Estimate

183.05

3.61

Achievement

Achievement

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

476.20

3.38

Allegations

Allegations

New Agreement

New Agreement

Strong Forcast

Strong Forcast

187.48

4.05

Achievement

Achievement

Buy Opinion

Buy Opinion

New Agreement

New Agreement

Sales Increase

Sales Increase

5.09

3.78

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

Revenue Increase

Revenue Increase

37.80

3.41

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

Dividend Declares

Dividend Declares

Earnings Decline

Earnings Decline

16.01

3.90

Achievement

Achievement

Allegations

Allegations

Approval

Approval

Beat Estimates

Beat Estimates

31.56

3.37

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

New Agreement

New Agreement

105.79

3.75

Failure

Failure

HR Changes

HR Changes

Insider Buying

Insider Buying

Investors Buying

Investors Buying

94.80

3.47

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Buy Opinion

Buy Opinion

Expansion Activity

Expansion Activity

91.19

3.09

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Buy Rating

Buy Rating

Enters Oversold Territory

Enters Oversold Territory

414.74

4.15

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

Concerns

Concerns

New Product

New Product

757.68

3.40

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Failure

Failure

HR Changes

HR Changes

196.25

3.36

Bearish Momentum

Bearish Momentum

Outperform

Outperform

Price Target Lowered

Price Target Lowered

Sales Increase

Sales Increase

Economic Indicators

Core Inflation YoY

Core Inflation YoYPrevious

3.80%

Forecast

3.70%

Inflation Rate MoM

Inflation Rate MoMPrevious

0.40%

Forecast

0.30%

Inflation Rate YoY

Inflation Rate YoYPrevious

3.50%

Forecast

3.50%

Top Trending Stocks

NVAX

Novavax

+98.66%

8.88

SG

Sweetgreen

+33.96%

31.56

SOUN

SoundHound AI Inc

+7.16%

5.09

NVDA

NVIDIA

+1.27%

898.78

SNY

Sanofi ADS

+1.21%

49.28

Top Gainers Stocks

LIDR

AEye

+118.64%

2.58

NVAX

Novavax

+98.66%

8.88

PW

Power REIT (MD)

+58.28%

0.69

ITOS

iTeos Therapeutics

+43.07%

17.44

SRTS

Sensus Healthcare

+38.85%

5.29

Top Losers Stocks

MGNX

MacroGenics

-77.44%

3.31

EVLV

Evolv Technologies Holdings

-38.54%

2.36

XPOF

Xponential Fitness

-31.45%

8.48

FAT

FAT Brands

-27.73%

5.42

AVD

American Vanguard

-27.69%

9.14

High Volume Stocks

NVAX

Novavax

+98.66%

8.88

SOUN

SoundHound AI Inc

+7.16%

5.09

TSLA

Tesla

-2.04%

168.47

AAPL

Apple

-0.69%

183.05

AMD

Advanced Micro Devices

-0.31%

151.92

Get all the pieces of the puzzle on important data activity and Stay Ahead: Stock Market Updates, Expert Analysis, and Future Predictions

Stay Informed with StocksRunner

Unlock the knowledge that 10,000+ subscribers already cherish. Join for exclusive insights and stay ahead in the stock game! Enter your email to receive daily alerts

Real-time stock market updates

Expert stock analysis

Investment strategies

Top stock recommendations

In-Depth Stock Analysis

Stock Sentiment Visualization

Daily Alerts for Stock Market Insights

Disclaimer:

Past performance, whether actual or indicated by historical tests, is not indicative of future success. Results are based on strategies not previously available to investors and may not reflect actual investor returns.

Readiness and Sentiment Indicators, as well as the total score, are calculated using historical data and assumptions integral to the model, and they may be subject to losses. Active trading may not be suitable for individuals with limited resources, investment experience, or a low-risk tolerance. Your capital is at risk.

Please note that StocksRunner and its affiliates ("TS") do not offer, solicit, or endorse securities, derivatives, investment advice, or strategies of any kind. This information is for illustrative purposes only. Do not rely on it for investment decisions.

Before making any investment, we recommend considering its appropriateness for your situation and seeking relevant financial, tax, and legal advice.