Super Micro Stock Soars 18% This Week - Is a Comeback in Sight?

Super Micro stock surged 18% this week amid AI server demand and an upcoming financial update. Is this a true comeback or just a speculative rebound?

Feb 06 2025

Feb 06 2025

Super Micro Computer ($SMCI) has been a high-flying name in the semiconductor industry, often mentioned alongside giants like AMD, Qualcomm, Marvell, and even Nvidia. However, the company’s meteoric rise was halted when short-seller research firm Hindenburg Research uncovered significant accounting irregularities, leading to a 70% stock plunge.

The scandal not only caused a loss of investor confidence but also led to the resignation of its auditors, Ernst & Young (EY), and a delay in submitting its annual reports to Nasdaq, leaving the stock under the looming threat of delisting.

Despite these setbacks, Super Micro has experienced a remarkable 18% surge this week. Could this be the beginning of a comeback, or is this just a temporary rebound fueled by speculation?

Super Micro Computer ($SMCI) has been a high-flying name in the semiconductor industry, often mentioned alongside giants like AMD, Qualcomm, Marvell, and even Nvidia. However, the company’s meteoric rise was halted when short-seller research firm Hindenburg Research uncovered significant accounting irregularities, leading to a 70% stock plunge.

The scandal not only caused a loss of investor confidence but also led to the resignation of its auditors, Ernst & Young (EY), and a delay in submitting its annual reports to Nasdaq, leaving the stock under the looming threat of delisting.

Despite these setbacks, Super Micro has experienced a remarkable 18% surge this week. Could this be the beginning of a comeback, or is this just a temporary rebound fueled by speculation?

Why Is Super Micro Stock Jumping Today?

Super Micro recently announced that it will provide an update on its financial performance for the fiscal second quarter on February 11. Investors are hopeful this update will shed light on the ongoing accounting issues that have plagued the stock in recent months.

The company also faces a critical deadline: it must submit its delayed annual reports for the previous fiscal year by February 25 to avoid delisting from Nasdaq. If it confirms its intention to file the reports before this deadline, investor sentiment could continue to improve.

Super Micro is ramping up production of its AI servers built on Nvidia’s cutting-edge Blackwell platform. This latest generation of GPUs from Nvidia is expected to play a pivotal role in the artificial intelligence revolution, particularly in data centers. With AI computing demand surging, Super Micro’s ability to integrate Nvidia’s latest technology into its server offerings could position it as a major beneficiary in this high-growth sector.

The short-seller firm that originally exposed Super Micro’s accounting discrepancies, Hindenburg Research, recently announced its closure. While this does not absolve the company of its past financial issues, the departure of one of its biggest critics has likely reduced some of the immediate bearish sentiment around the stock.

Analyst Sentiment - Bullish or Bearish?

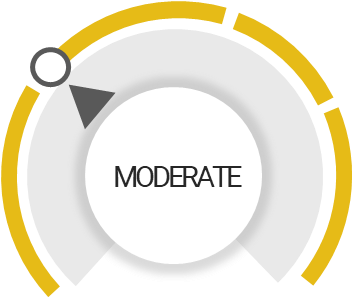

Super Micro’s stock currently holds a Sell recommendation with an overall score of 3.05/5, based on 33 key events over the past 90 days from financial news channels and social media platforms. Analysts remain divided on the stock's outlook:

Can Super Micro Regain Investor Confidence?

2025 is shaping up to be a make-or-break year for Super Micro. To regain investor confidence, the company must address two critical challenges:

Investors will be closely watching how Super Micro handles its financial reporting and whether it can provide a clear, accurate, and timely submission of its annual results. The longer the uncertainty drags on, the more difficult it will be for the company to regain credibility among institutional investors.

The company’s continued collaboration with Nvidia and its push into AI server production present significant long-term opportunities. If Super Micro can capitalize on the growing demand for AI-driven computing solutions, it could emerge stronger despite its past setbacks.

Is Super Micro a Buy, Hold, or Sell?

At the core of Super Micro’s comeback potential lies its ability to deliver transparency and meet financial reporting deadlines. If the company successfully submits its delayed annual reports and clears regulatory hurdles, it could lay the groundwork for a more sustainable recovery.

At the same time, its partnership with Nvidia and its strong positioning in the AI-driven server market present compelling growth opportunities. For risk-tolerant investors willing to endure volatility, Super Micro could offer upside potential. However, for those seeking stability, the stock remains a speculative play until the accounting concerns are fully addressed.

Watch for Super Micro’s financial update on February 11 and its Nasdaq compliance deadline on February 25—these dates will be crucial in determining whether this rally has legs or is just a temporary bounce.

SMCI Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Trading below its fair value

Risk Analysis

Investors losing their confidence

Unlock insights and stay ahead in the stock market game. Click Here For More SMCI in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Invest.Sensei

Invest.Sensei