Palantir Stock Soars to All-Time High Is $PLTR Still a Buy or a Bubble Waiting to Pop?

Palantir stock hits an all-time high as $PLTR surges 400%. Is it still a buy or a bubble ready to pop? Explore key risks and growth drivers.

Jul 16 2025

Jul 16 2025

Palantir stock PLTR has soared to an all-time high of $149.81 per share after a 400% surge, driven by rapid expansion in the U.S. private sector, now 30% of its revenue. But with sky-high valuations, is Palantir stock still a buy, or is it a bubble waiting to pop if market sentiment reverses?

Why Is Palantir Stock Rising?

Palantir Technologies is capitalizing on its momentum in both government and commercial sectors. Once focused primarily on U.S. federal contracts (still 42% of revenue), Palantir’s pivot toward commercial customers with its Foundry platform and AIP bootcamps has become a key growth driver, targeting 68% growth in commercial revenue this year.

Strategic partnerships with Databricks and Elon Musk’s xAI further reinforce Palantir’s position in the AI and data infrastructure space, while initiatives like “Warp Speed for Warships” expand its defense-related operations.

Is PLTR Overvalued?

Despite its strong business momentum, Palantir stock is trading at extreme valuations 97x sales for 2025 and 77x for 2026. Analysts at Mizuho, who previously rated the stock “Underperform,” upgraded it to “Neutral” but set a $135 price target, below the current price.

The concern is clear, If the market sentiment shifts, Palantir high valuation could correct sharply.

Risks

Palantir advanced solutions require significant investment in implementation and maintenance, often costing millions, limiting its reach primarily to large enterprises. For smaller businesses, these costs are prohibitive, potentially capping Palantir’s market size.

So, If Palantir cannot lower pricing or expand into more accessible offerings, it may slow its pace of customer acquisition before scaling profitably, putting its growth story at risk.

While risks exist, many industry voices see Palantir as the “data infrastructure” of the AI era, much like utilities for water or electricity, essential for organizations navigating the age of big data and artificial intelligence.

As long as Palantir continues to meet growth targets, its valuation may remain supported. However, any deviation from its growth trajectory or broader market volatility could trigger a sharp pullback.

Bottom Line: Is Palantir Stock Still a Buy?

Palantir stock offers an exciting narrative for investors seeking exposure to AI and data analytics infrastructure. Its strong momentum and expanding customer base in the private sector support the bull case, but the premium valuation leaves little room for error.

PLTR is a high-risk, high-reward play that may require careful monitoring. Those bullish on AI’s future may find Palantir a worthwhile addition on pullbacks, while cautious investors may prefer to wait for a better entry point.

How to Track Palantir Stock for Your Next Trade

If you're watching Palantir stock for your next trade, it’s critical to stay updated on PLTR stock price movements, earnings reports, and analyst ratings. Palantir’s sharp moves can present quick swing opportunities for active traders and long-term setups for investors bullish on AI infrastructure and data analytics growth.

On StocksRunner.com, you can monitor live PLTR technical levels, insider buying activity, and option flow signals to help you decide when to buy or trim positions. Whether you're trading momentum or looking for a smart pullback entry, tracking Palantir stock news and daily volume trends can give you an edge in managing your risk while capturing upside.

Frequently Asked Questions (FAQs)

Q1: Is Palantir stock PLTR a good buy after reaching an all-time high?

A1: Palantir stock shows strong growth potential in AI and data analytics, but its high valuation means investors should weigh risks carefully before buying.

Q2: What factors are driving Palantir recent stock surge?

A2: Key drivers include expansion into the U.S. private sector, strategic AI partnerships, and steady government contracts boosting revenue growth.

Q3: Could Palantir stock be a bubble waiting to pop?

A3: With sales multiples near 100x, Palantir’s valuation is stretched. A market sentiment shift or missed growth targets could trigger a price correction.

Q4: How can I track Palantir stock movements and news effectively?

A4: Use real-time tools like StocksRunner to monitor PLTR price action, volume trends, earnings updates, and analyst ratings to make informed decisions.

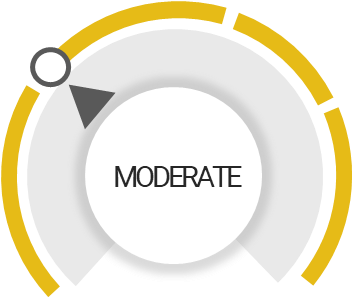

PLTR Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Outperform the market

Risk Analysis

Trading above its fair value

Unlock insights and stay ahead in the stock market game. Click Here For More PLTR in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Hadar.Goldberg

Hadar.Goldberg