Reddit Earnings Preview: AI Threat Looms Large

Reddit earnings preview reveals Google AI threatens user growth despite $425M revenue projections. Key metrics to watch before July 31 results.

Jul 22 2025

Jul 22 2025

Key Trading Points

This Reddit earnings preview analyzes the critical factors that will determine Reddit's stock performance when the company reports Q2 results on July 31.

The Google AI Challenge

Reddit upcoming earnings preview faces scrutiny from an existential threat: Google's AI Overviews feature. This new search functionality displays ready-made answers directly on search results pages, dramatically reducing the need for users to click through to external sites. For Reddit, which has positioned itself as "the place where the internet finds answers to every question," this creates a fundamental business model crisis.

The platform's greatest strength, becoming the go-to source for authentic, community-driven answers, now works against it. Google's AI systematically extracts Reddit's valuable content and presents it directly to users, essentially allowing Google to monetize Reddit's community contributions without driving traffic back to the platform.

Strong Revenue Projections Hide User Concerns

Despite the looming AI threat, this Reddit earnings preview reveals robust financial metrics. The company projects Q2 revenues of $425 million, representing a substantial 51% year-over-year increase. This growth primarily stems from digital advertising, which now accounts for approximately 75% of global advertising spend and continues expanding rapidly.

Reddit monetization strategy has evolved significantly, with new tools like Reddit Community Intelligence transforming the platform's 22 billion posts and comments into actionable commercial insights for advertisers. Analysts from Citi, led by Ronald Josey, express optimism about Reddit beating earnings expectations due to these advanced advertising capabilities.

However, this earnings preview shows that strong revenue growth may be masking a more concerning trend in user engagement. The deceleration in daily active user growth from 37% to 31% signals potential headwinds that could eventually impact revenue sustainability.

User Metrics Matter Most

Wall Street typically celebrates revenue beats, but Reddit's earnings preview demands deeper scrutiny of user metrics. In the social media ecosystem, users represent the core asset—they generate content, attract advertisers, and maintain platform vitality. Without sustained user growth and engagement, even impressive revenue numbers become unsustainable.

The July 31 earnings report will need to demonstrate that Reddit isn't merely a data repository for Google's AI to mine, but a thriving, irreplaceable community that users actively choose to engage with. The platform must prove it can reinvent itself for the AI era while maintaining its unique value proposition.

Trading Strategy

Ahead of this crucial Reddit earnings preview period, the company's $26.9 billion valuation reflects significant growth expectations already baked into the stock price. The 114% gain over the past 12 months, contrasted with the 10.5% year-to-date decline, suggests market uncertainty about the company's ability to navigate AI-driven disruption.

Traders should focus intensely on user engagement metrics rather than just revenue figures. Key indicators to watch in this earnings preview include Daily and monthly active user trends, Session duration and frequency data, Community participation rates and Geographic user distribution changes.

A revenue beat accompanied by deteriorating user metrics could signal a value trap, while strong user growth despite AI headwinds would validate Reddit's long-term investment thesis.

Adaptation or Extinction

Reddit earnings preview will serve as a litmus test for traditional content platforms in the AI age. The company must demonstrate that human-driven communities remain irreplaceable, even when AI can synthesize their collective knowledge. Success requires proving that Reddit's value extends beyond information extraction to genuine community building and sustained user loyalty.

For traders, this earnings preview represents more than quarterly numbers, it's a glimpse into how established internet platforms will survive the AI revolution. Reddit response to this existential challenge will likely set precedents for the entire social media sector's adaptation strategies.

Why This Earnings Preview Matters for Your Portfolio

Smart investors tracking Reddit stock know that this earnings preview offers unique insights beyond typical quarterly reports. With Reddit trading at premium valuations, understanding the Google AI impact becomes crucial for portfolio decisions. This social media stock faces unprecedented challenges that could reshape digital advertising revenue models across the entire sector.

Reddit earnings preview provides early signals about how AI disruption affects user-generated content platforms. Investors seeking exposure to social media growth should monitor whether Reddit can maintain its competitive edge against tech giants like Google. The platform's ability to monetize community engagement while defending against AI content extraction will determine long-term shareholder value.

For growth investors, Reddit's earnings preview reveals whether the company can transform from a content aggregator into an irreplaceable community platform. This transition could unlock significant value for early investors who recognize Reddit's potential to dominate authentic social interaction markets. The July 31 results will clarify Reddit's position in the evolving social media landscape and its capacity to generate sustainable returns for shareholders.

Reddit Earnings: Key Questions Answered

How is Google AI affecting Reddit's business model?

Google AI Overviews feature extracts Reddit content and displays answers directly in search results, reducing the need for users to visit Reddit's platform. This threatens Reddit's traffic-dependent advertising revenue model and user growth sustainability.

What makes Reddit earnings preview different from other social media stocks?

Reddit faces a unique existential challenge where its strength as an answer source works against it. Unlike other social platforms, Reddit's value lies in community-driven content that Google can easily extract, making user retention metrics more critical than traditional social media engagement.

Is Reddit stock a good investment despite AI threats?

Reddit projects 51% revenue growth to $425 million, but daily user growth has slowed from 37% to 31%. The investment thesis depends on whether Reddit can prove irreplaceable community value beyond information extraction, making it a high-risk, high-reward play in the AI era.

RDDT Stock Analysis

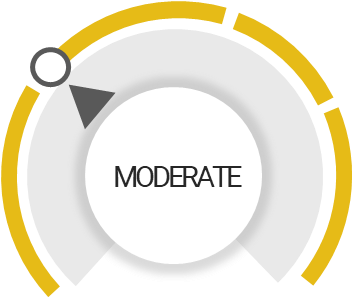

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Trading below its fair value

Expands stock buyback program

Unlock insights and stay ahead in the stock market game. Click Here For More RDDT in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Invest.Sensei

Invest.Sensei