Intel Surpasses Expectations, Stock Climbs After Hours

Intel surpassed Wall Street expectations with strong earnings, reporting a profit of 13 cents per share and $14.3 billion in revenue, driving its stock up after hours.

Jan 30 2025

Jan 30 2025

Intel Corp. surprised Wall Street with better-than-expected earnings, reporting a profit of 13 cents per share and revenue of $14.3 billion, outpacing analysts' expectations of 12 cents per share and $13.8 billion in revenue.

Despite this positive surprise, the company’s forecast for the first quarter of 2025 has raised some concerns.

Intel Corp. surprised Wall Street with better-than-expected earnings, reporting a profit of 13 cents per share and revenue of $14.3 billion, outpacing analysts' expectations of 12 cents per share and $13.8 billion in revenue.

Despite this positive surprise, the company’s forecast for the first quarter of 2025 has raised some concerns.

First-Quarter 2025 Projections Fall Short

Intel's outlook for Q1 2025 shows an adjusted gross margin of 36%, falling short of the anticipated 39.3%. The company expects revenues to range between $11.7 billion and $12.7 billion, below the expected $12.8 billion. Despite this, investors seem to be overlooking the forecast miss, as Intel's stock rose in after-hours trading.

Intel’s foundry business generated $4.5 billion in revenue, in line with expectations. However, the personal computer market, which remains the company’s largest revenue source, only saw a modest increase in global shipments over the past year. This performance was lower than expected, as a strong recovery following a prolonged downturn failed to materialize.

Headwinds in Data Centers

Intel continues to grapple with weak demand for traditional data center chips and a declining market share in the personal computing sector. The company is undergoing a historic transformation, struggling to capitalize on the growing demand for advanced artificial intelligence (AI) chips – a sector dominated by Nvidia.

As companies ramp up their investment in AI, much of the focus has shifted to specialized processors capable of handling massive data volumes, negatively impacting demand for Intel's traditional server processors. Intel's CEO, David Zinsner, noted that the company’s forecast reflects seasonal weakness compounded by economic uncertainty, inventory digestion, and competitive dynamics.

Intel has made significant strides in its cost-reduction plan announced last year, aiming to enhance its growth trajectory. Zinsner emphasized that the company is embedding a culture of efficiency to improve returns on investment and profitability. He stressed the importance of high-quality execution to drive progress and unlock Intel’s value potential.

Intel also faces strategic uncertainty following the ousting of former CEO Pat Gelsinger last month. The appointment of two interim CEOs has raised questions about the company's recovery strategy, adding to investor concerns. Intel is currently valued at $86.3 billion, with its stock up 1% year-to-date but down 54% over the past 12 months.

Intel’s journey through the AI revolution and its efforts to regain market leadership will be pivotal as the company adapts to new industry challenges and opportunities.

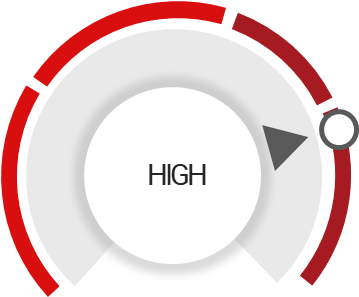

INTC Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Investors confidence is positive

Outperform the market

Unlock insights and stay ahead in the stock market game. Click Here For More INTC in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Elephant.Earnings

Elephant.Earnings