Intel Future Crossroads: What to Expect from the Chip Giants Upcoming Earnings Report

Intel is at a critical juncture as it prepares to release its earnings report. With significant losses expected, experts speculate on a potential takeover and future recovery strategies.

Jan 28 2025

Jan 28 2025

Intel Corporation is facing a critical turning point. After the departure of CEO Pat Gelsinger last month, the company is in search of new leadership to navigate the deep crisis it finds itself in, as its stock has dropped by 54% in the past year.

This significant market value decline, leaving Intel with a valuation of only $86 billion—less than 2% of Nvidia's worth—reflects the monumental challenges the company is facing, including major losses in chip development market share, colossal investments in factories that have yet to yield returns, and missing out on the AI revolution. As the company's fourth-quarter earnings report approaches, analysts are questioning what’s next and speculating whether Broadcom might come to the rescue with a potential acquisition.

Intel Corporation is facing a critical turning point. After the departure of CEO Pat Gelsinger last month, the company is in search of new leadership to navigate the deep crisis it finds itself in, as its stock has dropped by 54% in the past year.

This significant market value decline, leaving Intel with a valuation of only $86 billion—less than 2% of Nvidia's worth—reflects the monumental challenges the company is facing, including major losses in chip development market share, colossal investments in factories that have yet to yield returns, and missing out on the AI revolution. As the company's fourth-quarter earnings report approaches, analysts are questioning what’s next and speculating whether Broadcom might come to the rescue with a potential acquisition.

Intel is set to release its Q4 financial results this Thursday after market close. Analysts predict a sharp decline in revenue, down by 10% to $13.8 billion, and expect the company to report a net loss of $710 million, or 14 cents per share, compared to a profit of $2.66 billion or 63 cents per share during the same period last year. This will be the company's first earnings report since the departure of CEO Pat Gelsinger.

The financial results are expected to reflect the company's ongoing struggles, particularly in the production sector, where Intel has invested billions in new U.S.-based factories, but continues to face losses. Moreover, in the chip development sector, Intel has fallen behind competitors like AMD and TSMC, losing substantial market share due to delays in developing advanced manufacturing technologies.

Potential Acquisition

Intel's search for a new CEO is heating up, with Lip-Bu Tan, a well-respected figure in the semiconductor industry, considered a leading candidate. Tan, who previously served on Intel’s board, left in 2024 due to disagreements with Gelsinger but remains a strong contender due to his extensive experience in leading strategic changes.

Another prominent candidate is Renée James, an entrepreneur who founded Ampere Computing and worked at Intel for many years. James is known for her strategic brilliance, but her past complicated relationship with Intel's board may present challenges.

One significant challenge for the new CEO will be addressing Intel's production sector losses, which continue to weigh heavily on the company’s cash flow. Furthermore, Intel has struggled to keep up with the rapid pace of advancements in artificial intelligence (AI), a market where Nvidia has a dominant lead with over 80% market share, and AMD holds the second spot. Intel’s hesitance to invest heavily in AI-specific chips, such as those developed by Nvidia, has put the company in a precarious position.

Biggest Missed Opportunity

The biggest missed opportunity for Intel has been its slow approach to AI. While Nvidia quickly recognized the potential of AI and invested heavily in developing chips tailored for AI, Intel’s hesitant strategy—purchasing companies like Habana Labs and Nervana Systems—has not provided the technological foundation needed to effectively compete in this fast-growing sector.

Intel’s delay in entering the AI market has come at a steep cost. While Nvidia now has a market cap of $3.1 trillion, primarily due to its success in AI, Intel's market cap stands at a mere $86 billion. The new CEO will need to devise a clear strategy to enter the AI market, but it remains to be seen whether it’s too late for Intel to secure a meaningful share of a market already dominated by its competitors.

Competition

Intel’s financial situation is especially concerning. The company is expected to generate only around $4 billion in positive cash flow, while its factory investments require $20 to $25 billion annually. This liquidity crunch has led Intel to seek external investors for its new factories, a move that highlights the significant depletion of the company's cash reserves.

Additionally, reports suggest that Intel is losing skilled workers to its competitors, further complicating its ability to maintain its technological edge. Intel is also facing increasing competition in the server market, where it is losing market share to AMD, whose EPYC processors offer better performance and lower power consumption.

In China, a key market for Intel, the company faces rising competition from local semiconductor manufacturers, particularly those receiving extensive government support, such as Semiconductor Manufacturing International Corporation (SMIC). Intel’s efforts to maintain its market share in Asia are increasingly hindered by the widening technological gap between itself and its competitors, particularly in advanced manufacturing technologies.

Analyst Views

Analysts at Goldman Sachs see a 51% upside in Intel’s stock over the next year, contingent on the selection of a suitable CEO and the success of its recovery plan. They view Intel as a "once-in-a-lifetime" investment opportunity, pointing to government support under the CHIPS Act, which could help Intel expand its domestic manufacturing efforts. However, they also acknowledge the significant challenges facing the company, especially in AI, where Intel is far behind its competitors.

Speculation regarding a potential acquisition of Intel has recently driven the stock price up. Analysts from Citi have identified Broadcom as the most likely suitor for Intel, with the possibility of selling off Intel’s struggling manufacturing operations. While these rumors have generated excitement, the market remains skeptical without concrete details.

Out of 13 analysts tracking Intel’s stock, 12 have rated it a "hold" or equivalent, while one analyst has recommended "sell." The average price target is $24, reflecting a 15% potential upside from Monday’s closing price of $20.29.

INTC Stock Analysis

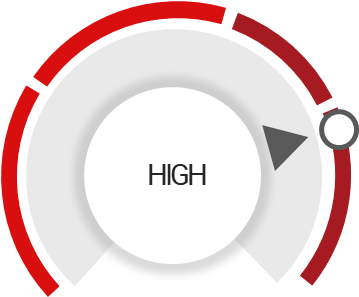

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Investors confidence is positive

Outperform the market

Unlock insights and stay ahead in the stock market game. Click Here For More INTC in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

alex.trader24

alex.trader24