GE Aerospace Stock: Strong Earnings Propel Optimism for Future Growth

GE Aerospace stock is soaring with strong earnings, rising demand, and a promising 2025 outlook.

Jan 23 2025

Jan 23 2025

The aviation industry is taking off again, and GE Aerospace Stock, representing General Electric’s aviation division, is soaring to new heights. The company’s Q4 earnings report has sent shockwaves through Wall Street, outperforming expectations and leaving investors with renewed confidence in its future trajectory.

Financial Results Beyond Expectations

GE Aerospace reported revenue of $9.9 billion for the fourth quarter of 2024, accompanied by operating profit of $1.9 billion. These figures blew past Wall Street’s forecasts of $9.5 billion in revenue and $1.7 billion in operating profit. Additionally, the earnings per share (EPS) reached $1.32, a significant surprise against analysts’ expectations of $1.04.

This robust performance underscores a strong rebound in the aviation sector and highlights GE Aerospace Stock as a top pick for investors looking to capitalize on this recovery.

Growth and Market Leadership

2024 proved to be a banner year for GE Aerospace. The company secured $50 billion in new orders, representing an impressive 32% increase compared to the previous year. Annual revenues hit $35.1 billion, a 10% year-over-year jump, cementing the company’s dominance in a rapidly recovering aviation market.

GE Aerospace Stock are closely watching the company's forecasts for 2025. The company is expecting double-digit growth in sales, with over 10% revenue growth, operating profit approaching $8 billion, and EPS projected at $5.30.

CEO Larry Culp credits the company’s supply chain improvements for its success, stating that better production efficiency contributed significantly to meeting growing demand. However, he acknowledged that overall production in the aviation sector is still below 2018 levels.

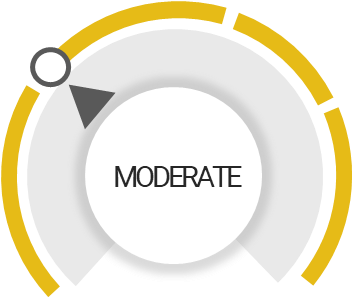

GE Stock Analysis

Total Score

Strengths

Upgraded on attractively valued

Unlock insights and stay ahead in the stock market game. Click Here For More GE in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Elephant.Earnings

Elephant.Earnings