Is Carvana Stock a Strong Buy Opportunity or a Risky Move?

Wondering if Carvana stock is a strong buy or risky move? Discover expert insights and whats driving its recent surge. Learn more now.

Jan 07 2025

Jan 07 2025

Key Highlight

Quick Recap

Carvana $CVNA, the e-commerce platform for buying and selling used cars, has experienced a remarkable stock price surge, rising 5% in a single day and seeing a 228% gain in 2024. This recent recovery came after RBC Capital Markets upgraded its stock rating to "Outperform," increasing its price target from $270 to $280. This change reflects growing optimism among analysts about Carvana’s potential to overcome recent challenges.

The company had been facing significant pressure due to a critical report by Hindenburg Research, which raised serious allegations about Carvana’s accounting practices and loan management. Despite this controversy, analysts are viewing the stock’s recent performance as a potential sign of resilience and growth.

On January 2, Hindenburg Research published a report accusing Carvana of engaging in accounting manipulations and poor loan management. The report labeled Carvana’s practices as a “father-and-son accounting fraud.” However, Carvana has vigorously denied these allegations, calling them baseless and a tactic by short-sellers attempting to profit from the company's struggles.

Despite this setback, Carvana's stock received a boost from RBC Capital Markets, which remains optimistic about the company's future. The firm pointed to Carvana’s $800 million loan sale in 2024 as a routine business activity and cited the company’s renewed partnership with Ally Financial as a sign of its stable financial position. RBC's analysis suggests that Carvana is well-positioned to capitalize on opportunities in the retail and commercial fleet markets.

Analyst Perspectives

RBC analysts are optimistic about Carvana's potential to grow, particularly in the commercial fleet market. The firm argues that Wall Street has underestimated the company’s ability to expand in this sector, which could provide substantial revenue streams moving forward. RBC also pointed to Carvana’s impressive 7.5% increase in stock price to $203.41 per share in early January, as a sign that investor confidence is on the rise.

RBC analysts noted "After Carvana's remarkable turnaround last year, we view the recent pullback as a buying opportunity."

This optimism is rooted in Carvana’s recovery from the challenges of 2023, which included operational hurdles and market skepticism. Analysts believe the company’s ability to bounce back strongly in 2024 signals a promising future.

Despite the positive outlook from RBC, not all analysts are entirely convinced about Carvana’s future. The Hindenburg Research report raised significant concerns about the company’s gross profit per unit (GPU), which is heavily influenced by its loan sales. If demand for these loans weakens or if Carvana faces difficulties in its loan management practices, the company’s profitability could be jeopardized.

These risks cannot be overlooked, especially as the company’s financial health and growth prospects continue to face scrutiny. Investors must weigh the potential for growth against the concerns raised by critics.

Strengths

The renewed collaboration with Ally Financial strengthens Carvana’s financial ecosystem, providing access to necessary capital for operations and growth.

Carvana’s expansion into commercial fleet markets offers significant upside. As businesses seek more efficient ways to manage vehicle fleets, Carvana’s e-commerce platform could provide a competitive advantage.

A 40% stock jump in late 2024 demonstrated the company’s ability to recover from setbacks and thrive, despite market skepticism.

Weaknesses

Carvana’s reliance on loan sales to drive gross profit presents a risk. If the market for loan buyers weakens, the company’s profitability could take a hit.

Concerns raised by Hindenburg and other critics about Carvana’s accounting practices continue to cast a shadow over the company’s financial transparency. Until these issues are resolved, the company may struggle to regain the trust of certain investors.

What’s Next for Carvana?

Looking ahead, Carvana’s stock will likely continue to be a source of interest for traders and long-term investors alike. Analysts predict that the company has significant upside potential, provided it can demonstrate consistent profitability in upcoming earnings reports.

Moreover, Carvana’s ability to capitalize on growth in the commercial fleet sector will be key. If the company can maintain its momentum in this space, it could see substantial revenue growth that would drive future stock price gains.

However, the next round of financial reports will be crucial in determining whether Carvana’s current growth is sustainable or if it’s merely a temporary rally. Investors will closely watch these reports for signs of stability and continued success.

Bottom Line

Carvana’s stock has shown an impressive recovery, fueled by optimism from analysts and strong market performance in 2024. The RBC upgrade and increased price target reflect confidence in the company's ability to recover and grow, particularly in the retail and commercial fleet markets. However, the risks highlighted by Hindenburg Research—especially regarding Carvana’s accounting practices and loan sales—cannot be dismissed.

Carvana represents both a buying opportunity and a warning sign. The company's ability to continue growing while addressing its financial challenges will determine whether it can build on its recent success or face further struggles. As always, investors should monitor the company’s upcoming earnings reports and market developments closely before making their next move.

Whether Carvana is a buying opportunity or a risky move will ultimately depend on its ability to deliver on expectations in the months ahead. For now, it remains a stock to watch closely.

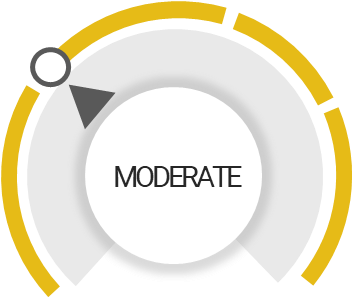

CVNA Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Outperform the market

Risk Analysis

Trading above its fair value

Unlock insights and stay ahead in the stock market game. Click Here For More CVNA in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

WallStWhiz

WallStWhiz