Palantir - The Success Story of 2024 and What Will Happen in 2025?

Belief in the potential of artificial intelligence is pushing Palantirs stock to new highs, but analysts are divided: is this the next Oracle or a bubble that will burst?

Dec 26 2024

Dec 26 2024

Few stocks have managed to record impressive performances like PALANTIR in 2024. The technology company, which specializes in complex data analysis, has seen its stock jump by 379% since the beginning of the year. But is there a solid basis for these dramatic increases?

When you look at the company's data, it's hard not to raise an eyebrow: the future earnings multiple has jumped to a dizzying level of 175, while the sales multiple has skyrocketed by 54. These are figures that are considered particularly unusual even for growth companies. But in the high-tech world of 2024, sometimes the numbers only tell part of the story. Palantir, which first became known for its intelligence solutions for government agencies, has positioned itself as a major player in the field of enterprise artificial intelligence.

Analyst Dan Ives of Wedbush, one of the company’s enthusiastic supporters, sees a historic opportunity: According to him, 2025 will be a breakthrough year in the field of enterprise AI, when companies will significantly increase their investment budgets in the field.

Palantir’s technology offers a unique advantage: the ability to take complex information and turn it into actionable business decisions. This is not just another AI platform, but a system built from the ground up to address complex organizational challenges.

Ives even went so far as to compare Palantir to software giant Oracle, but his target price per share – $75 – is actually lower than the current price. It’s an interesting paradox: Even the company’s biggest supporters are struggling to keep up with the pace of increases in the stock.

Pricing on Potential

There are two distinct camps in the market today: those who believe that Palantir will lead the enterprise AI revolution, and those who argue that it is a classic bubble that will burst sooner or later. Interestingly, traditional financial models are almost meaningless in valuing the company. The market is pricing Palantir based on belief in future potential, more than on current performance.

2025 will be crucial: Will Palantir succeed in turning its technological promise into a profitable business reality? Will companies really significantly increase their investments in AI as analysts expect? The answers to these questions will determine whether the sharp increases in the stock were justified or a bubble that has overinflated.

The fate of the stock seems to depend not only on the company's performance, but also on investors' faith in the future of enterprise AI in general, and Palantir's place in it in particular.

Contracts worth more than $600 million

The artificial intelligence company recently recorded a significant achievement by winning contracts worth up to $619 million from the United States Army, which strengthens its position as a leading technology supplier to the American defense sector. The new contracts are an expansion of the company's long-term cooperation with the American defense establishment.

At the heart of the deal is the Army Vantage program, an advanced data platform developed by Palantir specifically for the US Army. The system provides comprehensive solutions in the areas of operational readiness, supply chain management, and human resource management, using advanced artificial intelligence capabilities.

The new contracts reflect the growing trust of the US defense establishment in Palantir's technology, especially against the backdrop of increasing geopolitical challenges and the need for advanced technological solutions.

Furthermore, the new deal highlights Palantir's competitive advantage in the defense artificial intelligence market. The company's ability to provide customized solutions for the complex needs of the US Army, while integrating advanced AI technologies, positions it in a strategic position for continued growth in the defense sector.

Third Quarter

In its results for the last quarter, Palantir reported a profit of 10 cents per share and revenue of $725.5 million - above analysts' forecasts, which had expected a profit of 9 cents per share and revenue of $705 million. The strong results represent a significant improvement over the corresponding quarter last year, when the company reported a profit of 7 cents per share and revenue of $558 million.

The impressive growth in the company's two main operating segments was particularly notable: the government sector, which is the backbone of the company's operations, grew by 40% and reached revenue of $320 million. At the same time, the commercial sector showed an even more impressive growth of 54%, with revenue of $179 million.

Following the strong results, the company's management raised its annual revenue forecast to a range of $2.8-2.81 billion, higher than the previous forecast of $2.7-2.8 billion. The company's CEO, Alexander Karp, noted that demand for the company's artificial intelligence solutions remains strong from both government and commercial customers.

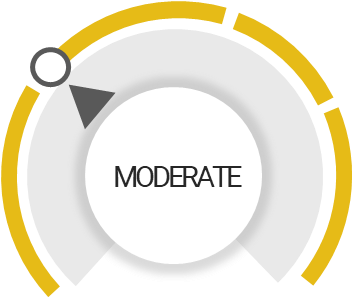

PLTR Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Outperform the market

Risk Analysis

Trading above its fair value

Investors losing their confidence

Unlock insights and stay ahead in the stock market game. Click Here For More PLTR in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Trend.Hunter

Trend.Hunter