Ahead of Micron Earnings Report: Will Demand for AI Chips Propel the Stock Forward?

Ahead of Micron earnings report, investors are eyeing how AI chip demand could boost its stock. Discover how Micron is positioned to capitalize on the AI revolution and what factors could impact its future growth.

Dec 17 2024

Dec 17 2024

Key Highlights

What to Expect in Q3 Earnings Report

Ahead of Micron Technology $MU third-quarter earnings report, investors are keen to understand how the demand for memory chips—particularly for AI applications—will impact the company’s performance. The earnings release is expected to highlight key figures, with analysts predicting $8.71 billion in revenue and $1.77 earnings per share (EPS). This will be critical in determining how well Micron is capitalizing on the rapidly growing AI sector.

Micron, a leader in memory chips for data centers, is strategically positioned to benefit from the growing demand for chips that power artificial intelligence (AI) applications. As AI technologies advance, data centers require increasingly sophisticated memory solutions, making Micron’s products essential in this space.

AI demand is one of the biggest growth drivers for Micron, and it’s transforming how memory chips are used across industries. AI applications require massive data processing capabilities, and Micron's memory chips, such as DRAM (Dynamic Random Access Memory) and High Bandwidth Memory (HBM), are at the heart of these data-heavy operations.

As major tech companies like Google, Amazon, and Microsoft ramp up their AI investments, the demand for Micron's advanced memory products will likely continue to increase. Investors will closely monitor Micron’s growth in the AI and data center sectors, looking for any signs of strong revenue from these key markets.

Operational Challenges

Despite the potential for AI-driven growth, Micron faces several operational hurdles. The DRAM market has been historically volatile, and inventory levels and pricing fluctuations continue to pose challenges. Micron has been working to navigate this volatility while ensuring product innovation remains strong.

High inventory levels and supply chain disruptions could impact the company’s profitability, and any signs of a slowdown in the DRAM sector could lead to disappointing results. Monitoring supply and demand dynamics will be crucial for investors looking to gauge the company’s ability to meet market expectations and sustain profitability.

Micron competitors, including Samsung and SK Hynix, are major players in the memory chip market. These companies put pressure on Micron by competing on price and technological innovation. With price volatility in DRAM and NAND flash markets, maintaining competitive pricing will be essential for Micron’s profitability.

To stay ahead, Micron must focus on its AI memory solutions, such as HBM, to secure premium pricing. In addition, developing cutting-edge technologies that cater to AI infrastructure demands will help Micron preserve its leadership position and stand out from its competitors.

Geopolitical and Regulatory Challenges

Geopolitical risks, particularly the tensions between the U.S. and China, continue to impact the semiconductor industry. Micron’s exposure to Chinese markets could face challenges due to potential tariffs and export restrictions. Any disruptions to its ability to operate freely in these markets could weigh on the company's stock price.

However, Micron position in AI technologies and U.S. government support through initiatives like the CHIPS Act provide a potential safeguard. The $6.2 billion CHIPS Act grant is designed to strengthen Micron’s U.S. manufacturing capabilities, reducing reliance on overseas production and enhancing the company’s competitive edge in the global market.

A key development for Micron is the $6.2 billion grant it received under the CHIPS Act. This initiative, aimed at strengthening U.S. semiconductor manufacturing, allows Micron to build advanced production facilities in Idaho and New York, creating thousands of jobs and boosting domestic chip production. For investors, this is seen as a significant growth opportunity, especially as the U.S. government pushes for greater semiconductor independence.

This grant provides Micron with a financial cushion and strengthens its long-term prospects, particularly in the AI chip market. As government-backed projects gain traction, Micron is poised to capture a larger share of the global semiconductor market.

Will AI Demand Propel Micron Stock?

Looking ahead, Micron’s future growth will largely depend on its ability to meet the rising demand for AI memory chips. AI workloads are expected to increase significantly, and Micron’s memory chips will be a crucial component in powering these systems. However, operational challenges in the DRAM market, geopolitical risks, and competition from global giants like Samsung and SK Hynix will continue to impact performance.

Despite these challenges, analysts remain optimistic about Micron’s future. JPMorgan has an “Overweight” rating on the stock with a $180 price target, citing growth potential in the AI and HBM markets. As demand for advanced memory solutions increases, Micron could see substantial growth over the next few quarters, provided it can continue to innovate and manage industry volatility.

Micron is at a critical juncture, and its ability to leverage demand for AI chips will determine its stock performance. With strong positioning in AI memory products, government backing, and continued technological innovation, Micron is well-positioned for the future. Investors should keep a close eye on the upcoming earnings report for signals on how the company is performing in AI markets and how it plans to navigate ongoing challenges.

If Micron continues to capitalize on the AI chip demand, its stock may see significant growth. AI’s rapid evolution will likely continue to drive the need for data center memory, and Micron stands ready to play a leading role in this expanding market.

MU Stock Analysis

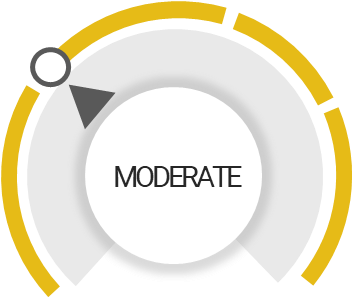

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Trading below its fair value

Outperform the market

Unlock insights and stay ahead in the stock market game. Click Here For More MU in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Henry.Chen

Henry.Chen