Tesla Run Can It Keep Soaring or Will It Crash and Burn?

Tesla stock has skyrocketed 70% in recent months. Is this a sustainable trend or a bubble about to burst?

Dec 16 2024

Dec 16 2024

Key Highlights

Is Tesla Headed for New Heights or a Correction?

Tesla has become one of the most intriguing stocks on the market, with every movement attracting global attention. Following the U.S. presidential elections in November 2024, Tesla's stock soared by around 70%, pushing it to a P/E ratio of 119—an astronomically high figure by any standard. This surge has prompted analysts to revisit their projections for the company, with some suggesting that Tesla's rapid growth is just beginning, while others caution that the stock might be out of sync with the company's underlying business performance.

Dan Ives, an analyst at Wedbush Securities, recently raised his target price for Tesla to $515, implying a 16% upside from its current levels. He believes that under the second term of President Donald Trump, the rules of the game for Tesla and autonomous driving will change, creating a more favorable environment for the company. Ives and many other analysts on Wall Street see Trump's policies as beneficial for Tesla, particularly in terms of reducing regulatory hurdles and making autonomous driving technologies more accessible.

Ives optimistic view also aligns with the belief that Tesla's path to a $2 trillion valuation has already started, and it could reach that milestone within the next 12 to 18 months. Tesla's use of artificial intelligence (AI) to enhance its self-driving capabilities has contributed to the optimism, with its Full Self Driving (FSD) technology continuously improving, allowing for increasingly autonomous driving experiences.

However, not all analysts share the same level of enthusiasm. Goldman Sachs recently published a report that tempered the excitement surrounding Tesla. According to their analysis, Tesla may struggle to maintain its growth trajectory, and they have set a target price of $250 per share, significantly lower than Tesla's current price of around $422. Goldman Sachs believes that Tesla will face stagnation in its delivery numbers in the near future, predicting deliveries of 510,000 units in the fourth quarter of 2023, compared to the 515,000 that Tesla itself has forecasted.

The divergence in predictions becomes even more apparent when considering Tesla 2025 delivery targets. Tesla has ambitious plans to deliver 2.3 million vehicles by 2025, driven by the launch of a new, more affordable model and expected annual growth of 20% to 30%. In contrast, analysts expect Tesla to deliver only 2.1 million vehicles, signaling a more cautious outlook for the company's growth.

Is Tesla Headed for Another Correction?

One of the most notable patterns in Tesla stock performance is its tendency to experience significant corrections after hitting new highs. For example, after reaching a peak in 2021, the stock lost almost 50% of its value the following year. A similar pattern was observed in 2022, when Tesla P/E ratio soared to around 119, only for the stock to tumble by nearly two-thirds in value afterward. These patterns raise questions about the sustainability of Tesla's current valuation.

While such high P/E ratios have historically signaled potential corrections, it’s important to remember that Tesla is no ordinary company. Despite its high valuation, Tesla has shown remarkable resilience, with its stock soaring by more than 740% in 2020, and it continued to rise by another 50% in 2021. This highlights the complexity of analyzing growth stocks like Tesla, where future expectations often play a major role in the stock’s valuation.

The Volatility Factor

Investors in Tesla should be aware of the stock's historical volatility. While Tesla has proven its ability to recover from sharp declines, the stock's tendency to experience significant dips after hitting historical highs warrants caution. The key question now is whether Tesla's plans and innovations, such as its expansion into autonomous driving and the development of new, more affordable vehicles, can justify its current high valuation.

The debate between optimistic analysts like Ives and the more cautious voices from firms like Goldman Sachs illustrates the uncertainty surrounding Tesla’s future. Investors will need to weigh the potential for continued innovation and growth against the risks of a possible correction or slowdown in the company's momentum.

High-Risk, High-Reward

Tesla remarkable surge over the past month and a half has ignited renewed optimism, particularly with the prospect of President Trump's second term influencing the company's growth. However, Tesla's astronomical P/E ratio and historical patterns of volatility suggest that investors should proceed with caution. While there is certainly room for further upside, especially with advancements in autonomous driving and AI, the risks of a significant correction remain.

For those looking to invest in Tesla, it’s essential to consider both the bullish forecasts and the bearish warnings. Tesla future performance will depend on its ability to deliver on its ambitious plans, but the stock volatile history serves as a reminder that high-growth companies come with inherent risks. Investors must carefully assess whether Tesla growth prospects outweigh the potential for a correction in the near future.

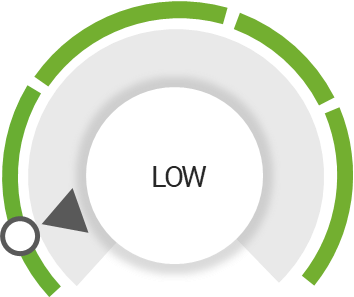

TSLA Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Investors confidence is positive

Outperform the market

Risk Analysis

Trading above its fair value

Downgraded on weak valued

Unlock insights and stay ahead in the stock market game. Click Here For More TSLA in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

WallSt.Watchdog

WallSt.Watchdog