Top Stock Market Movers Today With Momentum Trading Signals

When a stock pushes to a new 52-week high it sends a powerful message: Money is flowing, confidence is building and a new trend is forming. But for traders and investors that moment is also filled with pressure.

Dec 06 2025

Dec 06 2025

Stocks Hitting 52-Week Highs this Week

You are not just looking at price yo are thinking: Did I miss the move? Is this a breakout or a trap? Where’s the best risk-to-reward now?

This article isn't just showing you stocks that hit new highs. It’s designed to help you understand why the're moving and what it means for your next decision.

Below are the top stock market movers today, analyzed through momentum, volume, and trend strength the same signals professionals watch.

Apple Inc. | Market Leader at 52-Week High

Apple hitting new highs isn’t just another data point. It’s a statement.

Leadership changes in AI, renewed iPhone demand, and a powerful rebound in China are pulling institutional capital back into the stock. These aren’t emotional retail moves they’re strategic allocations.

Technical highlights: Trading above MA20, MA50, and MA200. RSI above 60 confirms bullish momentum. Heavy volume confirms broad participation.

Apple doesn't just move a chart. It moves the markt confidence.

AEO|Retail Breakout With Strong Momentum

After beating expectations and raising guidance, AEO pushed into a new 52-week high, sending a clear signal: the turnaround is real.

Momentum confirmed across all timeframes. Bullish RSI and volume expansion. Strong price structure

This is the type of breakout many traders hesitate to trust then regret ignoring.

Macy's | Turnaround at a New High

Macy's at a 52-week high represents something deeper than price: a shift in perception.

Improved efficiency, smarter execution, and a slow return of investor confidence are rebuilding the story. For value-oriented traders, Macy's is a reminder: Sometimes the strongest moves come from the most underestimated names.

Woodward | Clean, Textbook Uptrend

Not every winner is loud. WWD is climbing steadily thanks to real demand in aerospace and industrial technology. Higher highs, strong volume, and consistent institutional support define its chart.

This is the type of technical strength that seasoned traders respect.

WWD Stock Analysis

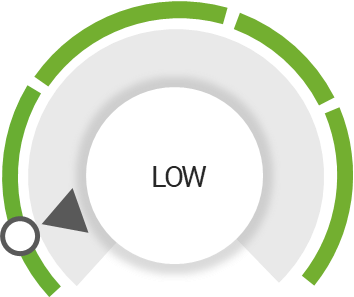

IQ Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Trading below its fair value

Outperform the market

Unlock insights and stay ahead in the stock market game. Click Here For More WWD in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

StocksRunner

StocksRunner