GameStop Bold Move into Bitcoin - Is It the Strategy That Will Save the Company?

GameStop bold move into Bitcoin aims to revive its struggling business. But will this crypto strategy be enough to save the company or is it too little, too late?

Feb 15 2025

Feb 15 2025

GameStop $GME has found itself caught between a nostalgic past and an uncertain future. Once the go-to store for physical video game purchases, GameStop now faces declining sales and a shift towards digital gaming. But rather than fading into obscurity, GameStop is exploring a bold new avenue—cryptocurrency.

By considering a move similar to MicroStrategy (MSTR), which has famously adopted Bitcoin as part of its business strategy, GameStop is betting that crypto could breathe new life into its brand. But, will this gamble pay off, or is GameStop jumping into a speculative market too late?

GameStop $GME has found itself caught between a nostalgic past and an uncertain future. Once the go-to store for physical video game purchases, GameStop now faces declining sales and a shift towards digital gaming. But rather than fading into obscurity, GameStop is exploring a bold new avenue—cryptocurrency.

By considering a move similar to MicroStrategy (MSTR), which has famously adopted Bitcoin as part of its business strategy, GameStop is betting that crypto could breathe new life into its brand. But, will this gamble pay off, or is GameStop jumping into a speculative market too late?

From Gaming Hub to Meme Stock

GameStop, once a beloved hub for gamers seeking the latest releases, is no stranger to challenges. As digital downloads and subscription-based gaming services like Sony's PlayStation Plus and Microsoft's Xbox Game Pass surged in popularity, physical game retailers like GameStop found themselves losing ground. While its traditional business model of selling physical games became less viable, GameStop managed to find new life in 2021 by becoming a meme stock.

The GameStop meme stock saga captivated the internet. A group of retail investors on Reddit’s WallStreetBets community sparked a short squeeze, causing GameStop’s stock to surge from under $20 to over $400. This unprecedented spike was fueled more by social media momentum and defiance against hedge funds than by GameStop's fundamentals. While the stock price has since dropped to around $28, the company’s story remains far from over.

GameStop Considers Bitcoin Potential Lifeline?

The latest development in GameStop’s journey? The company is reportedly exploring investing in Bitcoin and other cryptocurrencies, a move that has garnered attention. According to CNBC, GameStop could follow in the footsteps of MicroStrategy, a software company that transformed itself into a Bitcoin powerhouse by purchasing massive amounts of Bitcoin. Could this pivot into cryptocurrency be GameStop’s ticket to recovery?

MicroStrategy's strategy was simple yet bold: buy Bitcoin in large quantities. Over the years, MicroStrategy has accumulated billions of dollars worth of Bitcoin, with its CEO even changing the company’s name to reflect its new focus. For GameStop, this shift to Bitcoin could offer a chance to capitalize on the speculative nature of the crypto market and potentially ride the coattails of Bitcoin’s volatility. However, it comes with its own set of risks and uncertainties.

Will GameStop's Bitcoin Strategy Work?

GameStop’s stock surged by 6.5% following reports of its consideration to enter the cryptocurrency market. Investors appear to be optimistic about the move, but the question remains: Is this really the strategy that will save GameStop, or is it just another risky financial maneuver?

In theory, if Bitcoin's value increases, GameStop could see a short-term boost in its stock price. However, without a clear and sustainable business strategy beyond cryptocurrency speculation, GameStop’s success remains uncertain. It’s also important to note that the cryptocurrency market is far less forgiving today than it was during the 2021 bull run. While Bitcoin was once seen as a digital gold rush, it’s now more heavily scrutinized and prone to significant volatility. In this environment, GameStop’s strategy could easily backfire if Bitcoin's price falls.

What’s the Real Risk?

The primary risk GameStop faces with its potential Bitcoin investment lies in the speculative nature of the cryptocurrency market. If Bitcoin's value decreases, GameStop could find itself in an even worse financial position. Furthermore, without a solid business model that addresses the underlying issues within its gaming operations, Bitcoin investments won’t be enough to turn the company around in the long term.

While Bitcoin has demonstrated significant price increases in the past, there’s no guarantee that it will continue to grow at the same rate. Plus, GameStop would be investing in Bitcoin at a premium. MicroStrategy has been criticized for buying Bitcoin at prices much higher than market value, and if GameStop follows suit, it could end up holding overpriced Bitcoin that doesn't generate enough profit to offset its risks.

GameStop’s venture into cryptocurrency is a high-stakes gamble that mirrors the bold moves made by other companies looking to stay relevant in an ever-changing market. But unlike companies with robust and diversified business strategies, GameStop’s reliance on speculative crypto investments could leave it vulnerable if things go wrong. GameStop needs more than just a short-term rally in Bitcoin prices—it needs a long-term plan to reinvigorate its core business and adapt to the changing landscape of gaming.

While the crypto market can offer rapid profits, it's also rife with volatility and uncertainty. For GameStop, this bold move might generate some buzz in the short term, but it remains to be seen whether it will be enough to truly revive the brand. The future of GameStop will likely depend not only on the performance of Bitcoin but also on the company’s ability to innovate and find new avenues of growth in an increasingly digital world.

Key Takeaways

FAQs:

Why is GameStop investing in Bitcoin?

GameStop is exploring Bitcoin as a potential way to create value for shareholders due to the decline in its core video game retail business.

What’s the connection between GameStop and MicroStrategy?

Both companies are looking to use Bitcoin as part of their business strategy. MicroStrategy famously holds billions of dollars in Bitcoin, and GameStop is considering a similar approach.

Could this Bitcoin strategy really save GameStop?

While Bitcoin’s potential for profit exists, GameStop’s success will depend on much more than just crypto. It will need to address its core business challenges to thrive in the long term.

GME Stock Analysis

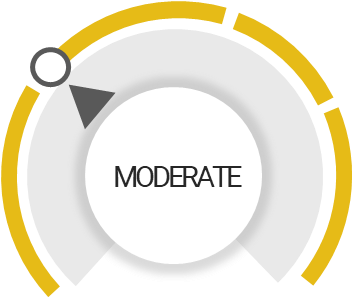

Total Score

Strengths

Earnings are forecast to grow

Trading below its fair value

Expands stock buyback program

Unlock insights and stay ahead in the stock market game. Click Here For More GME in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

alex.trader24

alex.trader24