Palantir Strong 2025 Forecast Drives Surge in After-Hours Trading: Key Insights and Analyst Reactions

Palantir strong 2025 forecast, with projected revenues surpassing analyst expectations, fuels a 15% after-hours stock surge. Key insights and analyst reactions inside.

Feb 03 2025

Feb 03 2025

Palantir Technologies (PLTR), a leader in data analytics and artificial intelligence (AI), delivered impressive results for Q4 2024, reporting a 14-cent per share profit and $828 million in revenue. These figures exceeded Wall Street's expectations, which had anticipated earnings of 11 cents per share on $778.89 million in revenue.

However, the real excitement for investors was the company’s robust outlook for 2025, projecting revenue between $3.74 and $3.76 billion, significantly higher than the $3.52 billion forecast by analysts. Palantir also expects Q1 2025 revenue to reach $858-862 million, surpassing market predictions of $799.4 million.

Palantir Technologies (PLTR), a leader in data analytics and artificial intelligence (AI), delivered impressive results for Q4 2024, reporting a 14-cent per share profit and $828 million in revenue. These figures exceeded Wall Street's expectations, which had anticipated earnings of 11 cents per share on $778.89 million in revenue.

However, the real excitement for investors was the company’s robust outlook for 2025, projecting revenue between $3.74 and $3.76 billion, significantly higher than the $3.52 billion forecast by analysts. Palantir also expects Q1 2025 revenue to reach $858-862 million, surpassing market predictions of $799.4 million.

Palantir's Impressive Growth in 2024

In Q4 2024, Palantir demonstrated impressive growth across multiple sectors, particularly in the U.S., where revenues surged by 52% to $558 million. The company’s commercial U.S. sector experienced a 64% increase, generating $214 million, while revenue from U.S. government contracts grew by 45% to $343 million. Overall, Palantir’s Q4 revenue amounted to $828 million, a 36% year-over-year increase, showcasing the company’s expanding footprint in both the public and private sectors.

Palantir’s founder and CEO, Alexander Karp, underscored the company’s pivotal role in the ongoing AI revolution. Karp stated, “Our business results continue to astonish, demonstrating our growing position at the heart of the AI revolution. Our early insights on turning large language models into a commodity have evolved from theory into fact.” Palantir’s continued success in securing large contracts and delivering innovative AI solutions strengthens its position in the rapidly evolving tech landscape.

Palantir has garnered strong optimism from analysts, with many forecasting a 16% upside potential for the stock. In Q4 2024, the company closed 129 deals worth at least $1 million each, 58 deals valued at $5 million or more, and 32 deals totaling at least $10 million. The U.S. commercial sector alone secured $803 million in contracts, reflecting a 134% year-over-year increase and a 170% rise from the previous quarter.

For the full year 2024, Palantir posted $2.87 billion in revenue, marking a 29% increase from the prior year. The company also generated a free cash flow of $1.25 billion, reflecting a 44% profit margin. At the end of 2024, Palantir had a strong cash position, with $5.2 billion in cash, cash equivalents, and short-term government bonds. This financial strength positions Palantir for continued growth and expansion in 2025 and beyond.

While Palantir generated over 40% of its Q4 2024 revenue from the U.S. government, the company is actively working to reduce its reliance on government contracts. In 2025, Palantir anticipates its U.S. corporate revenue will grow by at least 54%, reaching over $1.8 billion. This shift towards a more diversified client base will help the company strengthen its position in the commercial sector and continue its growth trajectory.

Palantir’s stock has experienced impressive growth, rising more than 8% in 2025 and a remarkable 390% over the last 12 months. The company is currently valued at $190.3 billion, making it one of the most valuable tech companies in the AI and data analytics space. Investors are closely watching Palantir’s next steps, as the company looks to capitalize on its AI expertise and strong market presence in the coming years.

Why Palantir’s 2025 Forecast Should Excite Investors

Palantir’s strong financial performance in Q4 2024, coupled with its optimistic 2025 forecast, positions the company as a leader in the AI and data analytics sectors. With significant revenue growth, expanding market opportunities, and a diversified client base, Palantir is poised for continued success. Investors should keep a close eye on Palantir as it navigates the rapidly changing AI landscape and continues to deliver value to both government and commercial clients.

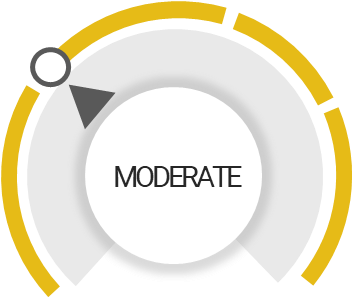

PLTR Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Outperform the market

Risk Analysis

Trading above its fair value

Investors losing their confidence

Unlock insights and stay ahead in the stock market game. Click Here For More PLTR in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Elephant.Earnings

Elephant.Earnings