Microchip Technology Stock Struggles: A Deep Dive into Its Fall from Grace

Why Microchip Technology stock is struggling in 2024. Learn about the challenges, leadership changes, and future outlook

Jan 24 2025

Jan 24 2025

Microchip Technology stock once stood tall as a giant, but recent trends suggest that this titan is struggling to find its footing. After a disappointing 2024, which marked its worst year since the 2008 financial crisis, the company is facing significant challenges that have left investors and analysts questioning its future trajectory. As of January 2025, Microchip Technology's stock has dropped 5%, extending a losing streak that started with a 35% decline in 2024. The company is grappling with a series of setbacks, including declining sales, an uncertain macroeconomic environment, and strategic missteps that have led to a wave of pessimism surrounding its future.

Microchip Technology stock once stood tall as a giant, but recent trends suggest that this titan is struggling to find its footing. After a disappointing 2024, which marked its worst year since the 2008 financial crisis, the company is facing significant challenges that have left investors and analysts questioning its future trajectory. As of January 2025, Microchip Technology's stock has dropped 5%, extending a losing streak that started with a 35% decline in 2024. The company is grappling with a series of setbacks, including declining sales, an uncertain macroeconomic environment, and strategic missteps that have led to a wave of pessimism surrounding its future.

The Sales Slump

Microchip Technology stock, renowned for providing essential chips across industries such as automotive, industrial, medical, and the Internet of Things (IoT), has seen its revenues plummet. Last year, its sales dropped by a staggering 40%, and analysts predict a similar trend for 2025, with estimated sales of $4.55 billion—well below what the company had hoped for in its peak years. While projections suggest a modest rebound to $5.25 billion in 2026, the road ahead is anything but certain.

The downturn in sales, particularly in the automotive and industrial sectors, where Microchip Technology stock has a significant presence, is largely attributed to the macroeconomic climate. With rising interest rates and global demand for chips cooling off, companies like Microchip find themselves at the mercy of broader economic forces, leaving them vulnerable to shifts in demand and supply chain disruptions. The competition from industry giants like Intel and Samsung only adds to the pressure.

Adding to the turmoil, Microchip Technology stock’s leadership is in flux. In November 2024, CEO Ganesh Moorthy, who had led the company through some of its most successful years, stepped down, with Steve Sanghi temporarily taking over the role. While leadership changes can sometimes signal a fresh start, the uncertainty that accompanies such transitions can also disrupt a company’s strategic direction.

The company also made the difficult decision to shut down its manufacturing facility in Arizona, resulting in the loss of 500 jobs. While this move might help reduce operational costs in the long run, it raises concerns about the company’s ability to maintain robust production capabilities, especially in the U.S., where it had hoped to capitalize on government incentives. The closure underscores the company’s struggle to balance cost-cutting with the need to invest in its future growth.

Disappointment with the U.S. Government

Further complicating Microchip Technology stock’s prospects is its halted negotiation with the U.S. government regarding a $162 million grant under the Chips Act, which would have supported the company’s local production efforts. Without this financial backing, Microchip Technology stock’s ability to expand its manufacturing footprint in the U.S. is severely limited, putting it at a disadvantage when competing with other global semiconductor players.

This, combined with a poor earnings report showing a 48% drop in net sales to just $1.16 billion, has sent a clear message to investors that the company is struggling. High inventory levels, weak global demand, and the challenges posed by inflation and interest rates have all played a role in the company’s declining fortunes.

Can Microchip Technology Stock Recover?

Despite these setbacks, there are still some potential silver linings. If the global economy stabilizes and demand for semiconductors picks up, Microchip Technology stock may be able to turn things around. However, such a recovery is contingent on multiple factors, including a shift in the broader economic climate and the company’s ability to navigate its ongoing internal challenges.

The key to Microchip Technology stock’s revival will likely hinge on its ability to reduce its inventory glut, optimize its operations, and forge new partnerships—especially with the U.S. government. If the company can successfully secure those partnerships, and if market conditions improve, it may find itself back on a path to growth.

Is Microchip Technology Stock Out of Ideas?

As of now, Microchip Technology stock appears to be on the ropes. Its stock price has dropped significantly, it faces fierce competition, and its recent performance has been underwhelming at best. The company's challenges are compounded by a weak global economy and supply chain disruptions, making it unclear when, or if, it will return to growth.

However, all hope is not lost. With a shift in market conditions, a new leadership vision, and potential breakthroughs in technology or strategic alliances, there is still a possibility for recovery. Investors will be closely monitoring how the company navigates these turbulent times, and whether it can regain its position as a key player in the semiconductor industry. For now, the road ahead remains uncertain, but for those willing to take the risk, the potential for a turnaround could still be on the horizon.

MCHP Stock Analysis

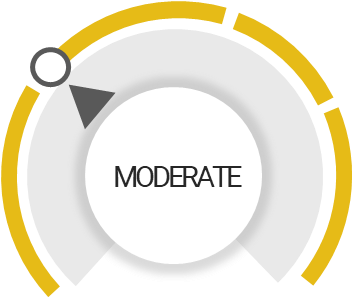

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Unlock insights and stay ahead in the stock market game. Click Here For More MCHP in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Invest.Sensei

Invest.Sensei