Intel Stock Soars: What the Acquisition Buzz Means

Intel stock soars amid acquisition rumors. Discover what this buzz means for investors and the future of the semiconductor giant.

Jan 17 2025

Jan 17 2025

Intel Corp. (NASDAQ: INTC), the iconic semiconductor company, experienced a dramatic 7% surge in its stock price, raising questions about what the acquisition buzz means for investors. This development, first reported by SemiAccurate, has captivated day traders, long-term investors, and institutional stakeholders alike. With a mystery buyer reportedly eyeing a full acquisition of Intel, the markets are buzzing with speculation about the implications for this once-dominant industry leader.

Who's Behind the Acquisition Buzz?

The report from SemiAccurate suggests that a highly resourced, unidentified entity is preparing to acquire Intel in its entirety. While the details remain scarce, the email leak that sparked this frenzy has injected new life into Intel's stock, which has been battered by challenges over the past year.

Intel has yet to comment on these rumors, leaving investors to wonder about the identity and intent of the potential buyer. Could this be a strategic play by a major competitor, a private equity powerhouse, or even a government-backed initiative? The acquisition buzz has raised more questions than answers, fueling speculation across the market.

What the Buzz Means for Intel Future

For decades, Intel dominated the semiconductor space. However, the rise of competitors like AMD and NVIDIA, coupled with rapid advancements in GPU technologies and AI applications, has eroded Intel’s market share and investor confidence.

The company’s struggles were compounded in 2024 when its stock price dropped 60%, reducing its market capitalization to $85 billion. Leadership turmoil further exacerbated the situation, with CEO Pat Gelsinger ousted amidst doubts about his turnaround strategy. As Intel fights to regain its footing, its vulnerabilities make it an attractive takeover target.

The rumors of a potential acquisition have sparked hope among some investors, suggesting that fresh capital and a new strategic direction could revitalize the company. However, challenges abound. With a market value of $85 billion, acquiring Intel is no small feat, and any deal would likely face intense regulatory scrutiny due to the company’s critical role in global technology infrastructure.

An acquisition would not only affect Intel but also reshape the competitive landscape of the semiconductor industry, potentially consolidating power in the hands of a single player or alliance. For investors, the stakes are high, and the outcome of this potential deal could significantly alter the industry’s dynamics.

In the midst of this uncertainty, Intel has taken steps to reposition itself. The company recently announced plans to spin off Intel Capital, its investment arm, into an independent venture capital firm by late 2025. This move aims to diversify funding sources and enable Intel Capital to pursue growth opportunities in areas like silicon, AI, and cloud technologies while allowing Intel to focus on its core business.

Intel Capital has invested in over 1,800 companies globally, with a portfolio exceeding $5 billion. Its track record includes notable startups in Israel such as Overwolf, Orcid Security, and AI21, showcasing its role as a forward-looking player in tech innovation.

What Investors Should Know

The 7% surge in Intel stock reflects optimism among traders, but the lack of concrete details about the rumored acquisition has left many investors cautious. Volatility in the stock creates opportunities for short-term gains, but long-term investors must weigh the risks tied to Intel’s structural challenges and uncertain future.

Intel stands at a pivotal moment in its storied history. Whether the acquisition materializes or the company charts a new strategic path, the coming months will shape its future and the broader semiconductor industry. For traders and institutional investors, this is a critical time to stay informed and prepared to act on new developments.

The recent Intel stock surge is a prime example of how market-moving news can create lucrative opportunities—but only for those who are prepared to act. Whether you’re a seasoned investor or new to the market, monitoring developments like acquisition rumors can help you stay ahead of the curve.

Understanding Intel’s position in the semiconductor industry, analyzing the implications of its restructuring moves, and assessing potential buyout scenarios can empower you to make informed decisions. The semiconductor sector remains one of the most dynamic and strategically important industries globally, and Intel’s future—whether shaped by a buyer or its own turnaround efforts—will likely have ripple effects across tech markets.

For investors looking to capitalize on Intel’s current volatility, this is a unique moment to evaluate your portfolio strategy. Are you ready to ride the wave of opportunity presented by this acquisition buzz? Stay informed, stay agile, and ensure you’re aligned with the market’s pulse to make the most of Intel’s evolving story.

Keep following for real-time updates and actionable insights on Intel $INTC and other market movers.

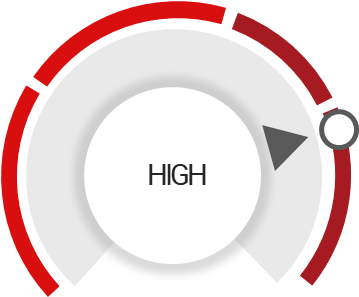

INTC Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Investors confidence is positive

Outperform the market

Unlock insights and stay ahead in the stock market game. Click Here For More INTC in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Invest.Sensei

Invest.Sensei