The Dual Challenge Facing AMD Stock: Rising Competition and Wall Street Downgrades

How rising competition and Wall Street downgrades are challenging AMD stock. Learn what is next for investors in 2025.

Jan 16 2025

Jan 16 2025

AMD (Advanced Micro Devices) finds itself at a critical juncture. As leading global investment houses downgrade their recommendations, the company faces mounting pressure amidst rising competition and financial forecasts pointing to significant slowdowns.

Wall Street Turns Bearish on AMD Stock

Wolfe Research recently adjusted its stance on AMD stock, lowering its recommendation from “Buy” to “Market Perform.” Analyst Chris Caso highlighted reduced revenue expectations for AMD’s GPU segment in data centers, historically a key growth driver. The firm cut its price target from $210 to reflect the diminished outlook, citing a more tempered growth trajectory in the AI and machine learning sectors.

The ripple effect was immediate. While competitors like Nvidia, Marvell Technologies, and Applied Materials saw gains after positive results from TSMC, AMD’s stock slid 0.7%, bucking the sector's upward trend. This reflects growing investor caution amid concerns about AMD’s ability to maintain its competitive edge.

Financial Forecast Cuts Raise Concerns

AMD stock’s revenue projections for Q1 were slashed to $6.6 billion, with earnings per share (EPS) adjusted to $0.80, a significant drop from prior estimates of $7.04 billion in revenue and $0.93 EPS. Wolfe Research’s updated annual forecast predicts $29.9 billion in revenue and $4.19 EPS, significantly lower than previous estimates of $33.6 billion and $5.33 EPS, respectively.

For context, Wall Street’s consensus still hovers at higher numbers, but the cautious revisions from key analysts signal that institutional investors should brace for a more volatile year ahead.

Multisystem Challenges

The slowing revenue growth in GPUs, particularly in the data center segment, has raised red flags. As GPUs drive innovation in artificial intelligence and machine learning, maintaining leadership in this domain is critical for AMD stock performance.

Following a strong Q4, AMD is anticipating a natural slowdown in the personal computer market, potentially affecting future AMD stock price trends.

The gaming sector, another vital revenue stream, continues to exhibit signs of softness as consumer demand levels off, impacting AMD stock valuation.

Challenges

Not all is bleak for AMD stock. The upcoming launch of the MI350 series GPUs in the second half of the year presents an opportunity to regain momentum. Unlike its predecessor, the MI325, which focused primarily on memory enhancements, the MI350 promises architectural advancements that could redefine AMD’s competitive positioning.

Additionally, Dell Technologies announced an expanded partnership with AMD, integrating its processors into business-class computers. This move could open new avenues for growth in the enterprise market, an area where AMD has traditionally lagged behind competitors like Intel.

AMD vs. Intel

The rivalry between AMD stock and Intel continues to intensify. AMD’s Ryzen 7 9800X3D processors have outpaced expectations, boasting unmatched demand. For instance, in Germany alone, 8,830 AMD processors were sold during the first week of 2025 compared to just 435 Intel units. The Ryzen series achieved a staggering 95% market share in the category.

Meanwhile, Intel has struggled with its Arrow Lake series, facing production issues and underwhelming performance reviews. AMD capitalized on this with robust sales, though the ongoing processor shortages underscore the need to ramp up production. AMD is collaborating with TSMC to address capacity challenges, aiming to meet unprecedented demand.

Market Sentiment

The broader market sentiment toward AMD stock has shifted, with major institutions tempering their outlooks:

Goldman Sachs downgraded AMD to “Neutral,” citing slower growth expectations in the GPU segment for data centers.

HSBC took a more bearish stance, lowering its rating to “Underweight” and forecasting further declines in AMD’s stock performance, particularly in light of intensifying competition.

The consensus among analysts is clear: AMD must demonstrate that its MI350 series GPUs deliver significant technological advantages while proving its ability to adapt to rapidly evolving market dynamics.

The Road Ahead

AMD stock’s current market valuation stands at $193.6 billion, with the stock down 2.5% year-to-date and 18% over the past 12 months. This underperformance places AMD stock under the spotlight, especially as competitors like Nvidia continue to dominate headlines with robust growth in AI-driven innovations.

To counteract this downturn, AMD must Successfully launch the MI350 series and differentiate it from Nvidia’s offerings. Leverage collaborations like the one with Dell to penetrate new markets and address Ryzen 7 processor shortages to capitalize on surging demand.

Is AMD Stock a Buy or Sell?

AMD stock’s journey forward will be anything but smooth. The dual challenge of heightened competition and Wall Street downgrades has created a pivotal moment for the company. For day traders and institutional investors alike, the coming quarters will test whether AMD can navigate these obstacles while seizing new opportunities.

he performance of its MI350 GPUs and the ability to maintain its competitive edge in AI and machine learning will likely define its trajectory in 2025. Investors in AMD stock should remain vigilant, as AMD’s ability to execute on these fronts will determine whether it can recapture its momentum and prove its resilience in the ever-evolving semiconductor landscape.

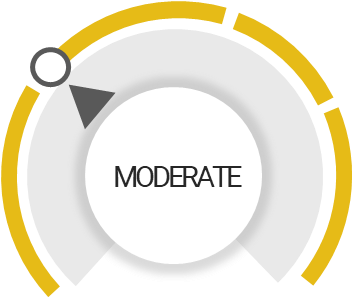

AMD Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Trading below its fair value

Outperform the market

Unlock insights and stay ahead in the stock market game. Click Here For More AMD in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

TechStockTracker

TechStockTracker