Rivian Stock Jumps Despite Q4 Delivery Decline: What Fueling the Optimism?

Rivian stock defies Q4 delivery dip. Discover what is driving investor confidence and learn about the electric vehicle maker future prospects.

Jan 03 2025

Jan 03 2025

Key Highlights

Rivian’s Q4 2024 Performance

Rivian Automotive, a rising star in the electric vehicle (EV) industry, recently released its Q4 2024 performance report. Deliveries dropped 19% to 14,183 vehicles compared to the same period last year, while production fell 9% to 12,727 units. Despite the decline, these numbers aligned with company projections, even slightly surpassing consensus estimates.

For the full year, Rivian produced 49,476 vehicles and delivered 51,579, remaining within its previously stated guidance range. These results showcase Rivian’s resilience in navigating a challenging year dominated by supply chain disruptions.

The Game-Changing Announcement

What turned investor sentiment around was Rivian’s announcement of resolving a critical supply chain bottleneck. The company confirmed that the component shortage impacting its R1 and RCV production platforms is no longer a constraint. This milestone sets the stage for an aggressive production ramp-up in 2025, a prospect that has injected fresh optimism into the market.

By eliminating this production hurdle, Rivian can focus on scaling operations, meeting demand, and improving efficiencies. While precise 2025 delivery targets remain under wraps, early indications suggest a strong upward trajectory, fueling investor enthusiasm.

While Rivian operates on a smaller scale, its ability to resolve supply chain issues and align production with demand positions it as a formidable contender in the EV race.

Analyst Takeaways and Market Sentiment

Ronald Josikow of Guggenheim expressed confidence in Rivian’s outlook, noting that Q4 production exceeded his estimate of 12,000 units and the consensus of 11,400 units. This outperformance, coupled with the resolution of supply chain challenges, could positively impact Rivian’s gross profit margins.

Guggenheim maintains a “Buy” rating for Rivian, with a price target of $18, representing a potential 10% upside. Such endorsements from analysts contribute to the growing market optimism surrounding Rivian’s future.

Looking Ahead

Investors are eager to see how Rivian capitalizes on its newfound operational freedom. The company aims to deliver approximately 56,000 vehicles in 2025, a significant leap from its 2024 output. Achieving this target will require flawless execution across production, logistics, and sales.

Rivian’s upcoming Q4 financial results, scheduled for February 20, are expected to provide further clarity on its near-term strategy. These updates will be closely watched for any revisions to guidance or announcements of new initiatives.

Despite a steep 35% decline in its stock price during 2024, Rivian’s recent developments have reignited investor confidence. The broader EV market faced headwinds, including slowing demand and supply chain disruptions. However, Rivian’s proactive resolution of production constraints could set it apart as a growth leader in 2025.

Final Thoughts

Rivian’s ability to address its supply chain issues signals a pivotal moment in its journey. While the EV sector remains fiercely competitive, Rivian’s focus on operational improvements and strategic growth initiatives provides a compelling narrative for investors. With the groundwork laid for a strong 2025, Rivian is well-positioned to deliver meaningful value to its stakeholders.

Rivian’s Q4 performance met expectations, with resolved supply chain issues boosting future prospects. The stock’s recent momentum reflects confidence in the company’s ability to scale production and increase deliveries.

Upcoming financial results and guidance updates will be critical in assessing Rivian’s trajectory.

For investors seeking exposure to the EV market, Rivian offers a high-risk, high-reward opportunity, contingent on its ability to execute its ambitious plans for 2025 and beyond.

RIVN Stock Analysis

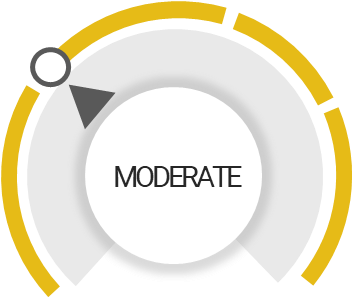

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Trading below its fair value

Outperform the market

Risk Analysis

Investors losing their confidence

Unlock insights and stay ahead in the stock market game. Click Here For More RIVN in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Sam.Bernstein

Sam.Bernstein