Can Reddit Sustain Its Incredible Growth Amidst New Challenges?

Reddit user base is booming, but can it keep the growth train rolling?

Nov 23 2024

Nov 23 2024

Key Highlights

Why Is Reddit Growing So Fast?

Reddit's stock has experienced significant volatility as investors weigh the company's impressive user expansion against long-term sustainability concerns. The social media platform, known for its diverse community-driven forums, is navigating a complex landscape of opportunities and challenges that could define its future market position.

The social media platform has demonstrated exceptional growth metrics, with daily active users reaching 97 million in the latest quarter, representing a striking 47% increase compared to the previous year. This substantial user base expansion has been partially attributed to Reddit's strong search engine visibility, with CEO Steve Huffman noting that "Reddit" has become the sixth most searched term on Google in the United States.

What’s Behind Reddit’s Stock Volatility?

The platform's organic growth has been particularly noteworthy, as users increasingly seek out Reddit directly rather than discovering it through third-party channels. This direct engagement suggests a strengthening brand presence and growing user loyalty, factors that typically signal sustainable growth potential in the social media sector.

The market reaction to Reddit's performance has been notably mixed, reflecting both enthusiasm and caution. During regular trading hours, the stock surged approximately 16%, driven by positive analyst coverage and strong October user metrics. However, after-hours trading saw an 8% decline, highlighting the market's complex assessment of the company's long-term prospects.

The volatility in Reddit's stock price can be attributed to several factors. Analyst upgrades and positive 2025 revenue forecasts have bolstered investor confidence, while profit-taking activities following the initial surge have created some downward pressure. Additionally, broader market uncertainty regarding social media platform sustainability and growing concerns about competition from established players like Meta and X (formerly Twitter) have contributed to the price fluctuations.

Can Reddit Keep Up the Pace?

Despite the current positive momentum, Reddit faces several significant challenges that could impact its growth trajectory. One of the primary concerns centers on Google's algorithmic changes and their potential impact on Reddit's visibility in search results. The search giant has begun leveraging the term "Reddit" in its search bar and placing sponsored links above organic results, potentially diminishing Reddit's organic exposure.

The competitive landscape presents another significant challenge. Reddit operates in a market dominated by well-established social media giants with substantial resources and user bases. The platform must continue to differentiate itself while maintaining its unique community-driven approach that has fueled its current success.

Future Outlook

Looking ahead, analysts maintain optimistic projections for Reddit's financial performance through 2025, with expectations of continued revenue growth and improved EBITDA margins. The platform's ability to attract and retain users while monetizing its growing user base will be crucial factors in meeting these projections.

Reddit's strength lies in its niche communities and authentic user-generated content, which have proven resistant to traditional social media competition. However, the company must address several key areas to maintain its growth momentum. These include developing sustainable monetization strategies that don't compromise user experience, navigating potential changes in search engine algorithms that could affect visibility, maintaining community engagement while scaling the platform, and competing effectively with larger social media platforms for user attention and advertising revenue.

Can Reddit Maintain Its User Growth?

The recent market response to Reddit's performance suggests that while investors are encouraged by current growth metrics, they remain cautious about long-term sustainability. The platform's ability to address these challenges while maintaining its unique community-focused approach will likely determine its success in the competitive social media landscape.

As Reddit continues to evolve and adapt to market challenges, investors and analysts will be closely monitoring key metrics such as user engagement rates, revenue growth, and the effectiveness of new monetization strategies. The company's performance in these areas will be crucial in determining whether it can maintain its current growth trajectory and justify market optimism about its long-term prospects.

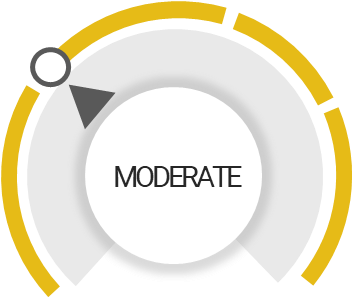

RDDT Stock Analysis

Total Score

Strengths

Earnings are forecast to grow

Upgraded on attractively valued

Trading below its fair value

Expands stock buyback program

Unlock insights and stay ahead in the stock market game. Click Here For More RDDT in-depth stock analysis.

Unlock Exclusive Stock Insights!

Join StocksRunner.com for daily market updates, expert analyses, and actionable insights.

Signup now for FREE and stay ahead of the market curve!

Why Join?

Find out what 10,000+ subscribers already know.

Real-time insights for informed decisions.

Limited slots available, SignUp Now!

Please note that the article should not be considered as investment advice or marketing, and it does not take into account the personal data and requirements of any individual. It is not a substitute for the reader's own judgment, and it should not be considered as advice or recommendation for buying or selling any securities or financial products.

Money.Maker

Money.Maker