Find new investment opportunities based on Market Sentiment Indicator. Manage watchlist risk with leading indicator of volatility See what influential analysts and investors are saying about stocks in your watchlist

Most Trending

-4.08%

+5.72%

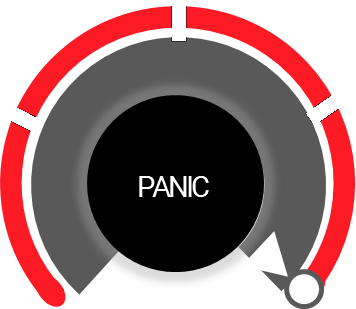

Stock Market Sentiment

Market Sentiment Based on 5,046 events Last updated Feb 21, 2025 22:23 Wall St. time

Fear & Greed Mood

Measures market expectations for future volatility.

Higher values indicate higher expected volatility.

Volatility

Market Heatmap

The size is based on the total events, the color is based on the sentiment and the height is based on the change in the price

Negative Positive Up Down NOKUAMDNVDARIVNUNHBABAAAPLWMTCOINGOOGSHOAMZNPLTRRCLBKNGCELHVIPSBLUETMUS

Negative Positive Up Down NOKUAMDNVDARIVNUNHBABAAAPLWMTCOINGOOGSHOAMZNPLTRRCLBKNGCELHVIPSBLUETMUS4.94

4.33

Buyback

Buyback

Expansion Activity

Expansion Activity

HR Changes

HR Changes

Insider Buying

Insider Buying

28.34

3.62

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

Buy Rating

Buy Rating

110.84

3.01

Achievement

Achievement

Bearish Momentum

Bearish Momentum

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

134.40

4.00

Achievement

Achievement

Allegations

Allegations

Bearish Activity

Bearish Activity

Bearish Momentum

Bearish Momentum

12.97

3.81

Achievement

Achievement

Approval

Approval

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

466.42

2.31

Bearish Momentum

Bearish Momentum

Buy the Dip

Buy the Dip

Buyout

Buyout

Cut Workforce

Cut Workforce

143.75

4.22

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

245.55

3.47

52-week Low

52-week Low

Achievement

Achievement

Allegations

Allegations

Bearish Momentum

Bearish Momentum

94.78

2.84

52-week High

52-week High

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

235.38

3.78

Achievement

Achievement

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

181.58

3.62

Achievement

Achievement

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Bullish Momentum

Bullish Momentum

10.65

2.96

Achievement

Achievement

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

216.58

3.79

Achievement

Achievement

Allegations

Allegations

Approval

Approval

Bearish Momentum

Bearish Momentum

101.39

3.55

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

234.26

3.54

Bearish Momentum

Bearish Momentum

Buyback

Buyback

Dividend Declares

Dividend Declares

Dividend Increases

Dividend Increases

4990.64

3.59

Achievement

Achievement

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

32.62

3.38

Bearish Momentum

Bearish Momentum

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

Buy Opinion

Buy Opinion

14.73

3.24

Beat Estimates

Beat Estimates

Bullish Momentum

Bullish Momentum

Buyback

Buyback

Dividend Declares

Dividend Declares

4.08

N/A

Allegations

Allegations

Bearish Momentum

Bearish Momentum

Expansion Activity

Expansion Activity

Failure

Failure

265.17

3.21

Achievement

Achievement

Beat Estimates

Beat Estimates

Downgrade

Downgrade

Expansion Activity

Expansion Activity

Latest Reviews

.INX

6013.13

-1.71%

3362.47M

VMC

252.86

-2.23%

393.83K

KELYA

13.87

+1.31%

398.65K

YETI

36.83

-0.22%

1.59M

UIS

4.70

-7.66%

995.06K

Who's Hot

CELH

32.62

+27.77%

62.02M

BABA

143.75

+5.72%

73.32M

VIPS

14.73

+1.38%

7.63M

U

28.34

+1.21%

39.48M

TMUS

265.17

-0.09%

3.54M

Market Warriors

BOXL

3.10

+51.22%

569.67K

ASST

0.66

+10.45%

1.11M

CYN

7.76

+9.76%

1.69M

SABR

4.52

+8.92%

14.25M

FNGR

1.37

+5.38%

642.16K

Comeback Kings

RILY

3.40

+10.39%

4.74M

CYN

7.76

+9.76%

1.69M

TLRY

0.95

+9.66%

79.02M

TANH

3.17

+6.02%

3.08M

BABA

143.75

+5.72%

73.32M

Market Movers

NVDA

134.40

-4.08%

223.88M

PLTR

101.39

-4.59%

127.37M

BABA

143.75

+5.72%

73.32M

RIVN

12.97

-4.70%

69.89M

CELH

32.62

+27.77%

62.02M

Get all the pieces of the puzzle on important data activity and Stay Ahead: Stock Market Updates, Expert Analysis, and Future Predictions

Stay Informed with StocksRunner

Join over 10,000+ subscribers who value exclusive insights. Stay ahead in the stock market! Enter your email for daily alerts

Real-time stock market updates

Expert stock analysis

Investment strategies

Top stock recommendations

In-Depth Stock Analysis

Stock Sentiment Visualization

Daily Alerts for Stock Market Insights

Disclaimer:

Past performance, whether actual or indicated by historical tests, is not indicative of future success. Results are based on strategies not previously available to investors and may not reflect actual investor returns.

Readiness and Sentiment Indicators, as well as the total score, are calculated using historical data and assumptions integral to the model, and they may be subject to losses. Active trading may not be suitable for individuals with limited resources, investment experience, or a low-risk tolerance. Your capital is at risk.

Please note that StocksRunner and its affiliates ("TS") do not offer, solicit, or endorse securities, derivatives, investment advice, or strategies of any kind. This information is for illustrative purposes only. Do not rely on it for investment decisions.

Before making any investment, we recommend considering its appropriateness for your situation and seeking relevant financial, tax, and legal advice.